Fraud Detection Solutions

✓ Detect card fraud in real-time and non-stop 24/7

✓ Offer various protection features and cross-industry fraud prevention

✓ Comply with PCI DSS

✓ Largest market share of Japanese major credit card companies

Combat Credit Card Fraud and Protect Your Customers

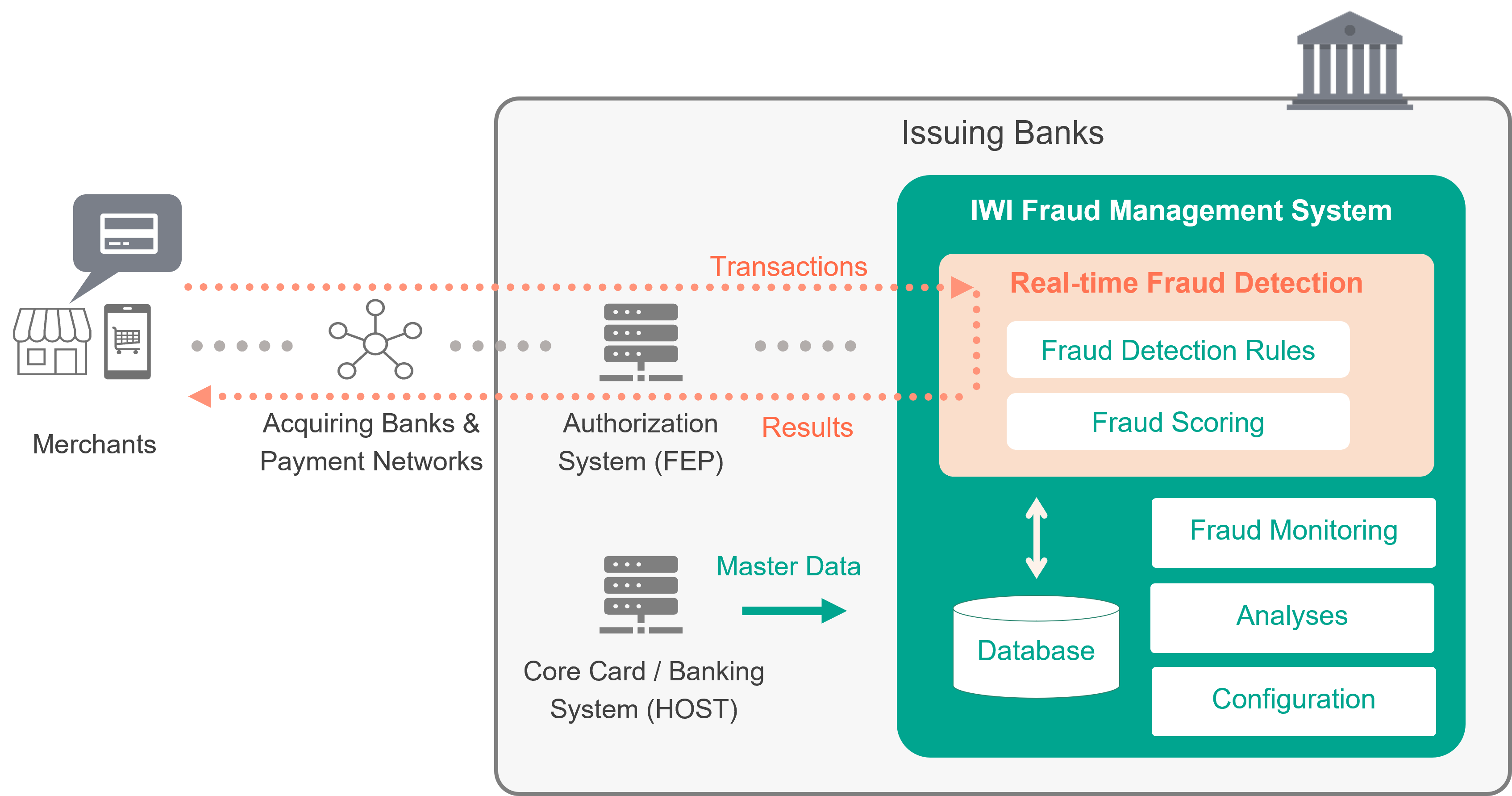

Measures to prevent fraudulent card usage are being implemented in various ways by the different players involved in the payment process. For instance, card issuers stand out as they operate 24/7 to instantly judge whether a transaction is fraudulent in real-time when it occurs.

IWI provides a real-time fraud detection system to support you.

Product/Service

Our Fraud Management Solutions

Robust, yet Flexible

Our solution stops fraudulent credit card transactions in real-time. Using the system, organizations are able to monitor fraud, investigate cases, and analyze details.

・Fast data processing, high availability, and high security

・Supports both rule-based and score-based fraud detection

・Available either on-premises or as a cloud service

Real-Time Detection

Our real-time fraud detection system connects and responds to the authorization system instantly. Various other types of information used for fraud detection and monitoring are integrated via batch processing from the core system. This information is then cross-referenced with transaction history and can be stored and utilized within the system.

Reason

Other Services

Detection Rule Consulting

IWI analyzes the performance of the fraud detection rules and suggests improvements for rule-based fraud detection.

Score Detection POC

IWI runs a POC of a cutting-edge fraud scoring engine for score-based fraud detection. If the organization is already using a fraud scoring engine, IWI can conduct a performance comparison.

Fraud Management Operations

IWI performs fraud management operations such as transaction monitoring, fraud investigation, analysis, and reporting for organizations that wish to outsource their operations.

Utilizing these services, you will recieve the following benefits:

- Reducing fraud damage

- Reducing false-positive detections and increasing sales

- Reducing the workload of the fraud management team

Cutting-edge initiatives

Cross-Industry Initiatives to Reduce Fraud

Fraud prevention requires not only individual measures by various players, such as credit card companies, but also industry-wide efforts. Therefore, IWI has launched a project to promote a unified industry approach to fraud prevention, encouraging the sharing of fraud data across payment-related companies and the development of services utilizing the shared data.

Please feel free to contact us regarding system implementation, collaboration, and other inquiries.

Cross-industry initiatives

Established Security Consortium with JCB to promote industry-wide (issuers, acquirers, and merchants) anti-fraud measures. The measure is not only for JCB brand's transaction, but also for other international payment brands.

Collaboration between issuers

Developed shared AI scoring service with PKSHA Technology. By shareing information, users can learn and prevent fraud that occurs at other companies.