Supporting organizations to combat credit card fraud and protecting consumers are our primary missions in the society.

IWI has been providing credit card fraud management solutions for over 30 years and has abundant knowledge and experience in this field.

We support organizations with a wide variety of fraud management solutions such as consulting service, POC service, a fraud management system, and fraud management operations that are essential for robust fraud management.

Digital Payments and Fraud

The significant growth of digital payments ecosystem has been accelerating the transition into a cashless society, and in 2030 the transaction volume of all payment cards will reach $79.14 trillion worldwide.

Accordingly, digital payments fraud—especially credit card fraud—has been rapidly increasing, and the global loss due to payment cards fraud is estimated to reach $49.32 billion in 2030. The COVID-19 pandemic has unleashed an explosion of card-not-present transactions and increased the risk of fraud losses*.

In order to combat fraud and protect consumers, organizations need to build a more powerful and effective fraud management strategy.

*reference: Nilson Report (December, 2021) Issue 1209

IWI Fraud Management Solutions

We analyze the performance of the fraud detection rules and suggest improvements for rule-based fraud detection.

After the improvements, organizations will receive the following benefits:

- Reducing fraud damage

- Reducing false-positive detections and increasing sales

- Reducing the workload of the fraud management team

STEPS OF THE CONSULTING SERVICE:

POC Service (Score)

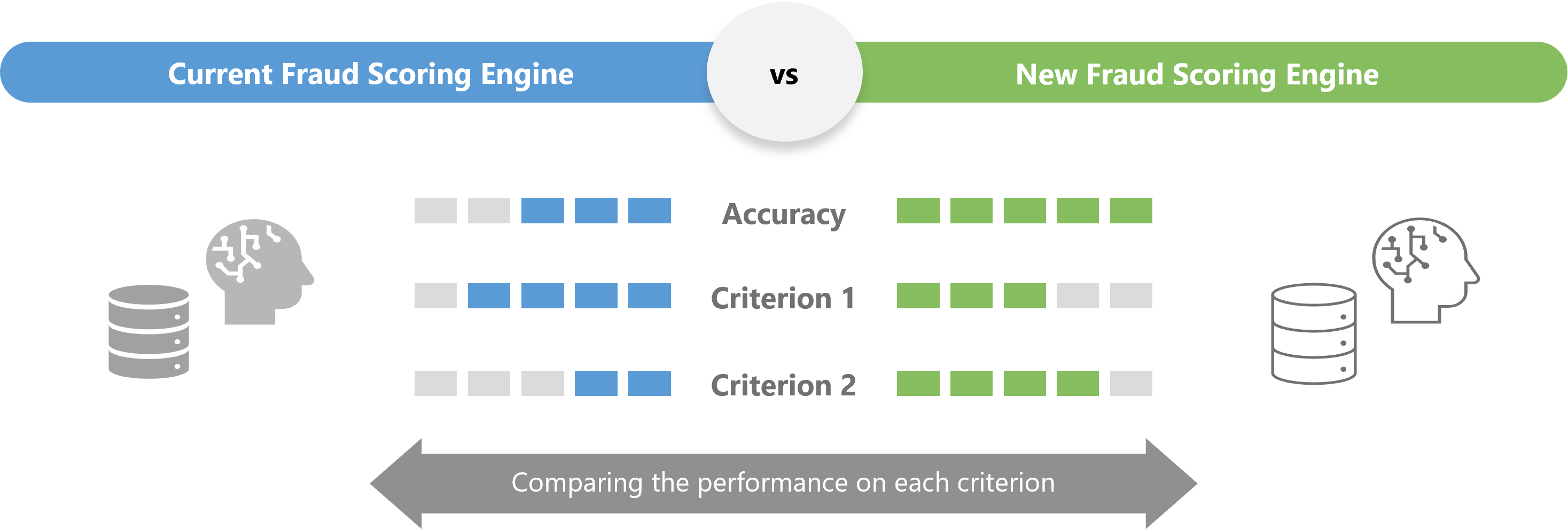

We run a POC of a cutting-edge fraud scoring engine for score-based fraud detection.

If the organization is already using a fraud scoring engine, we will perform a performance comparison.

After switching to the higher-performance scoring engine, organizations will receive the following benefits:

- Reducing fraud damage

- Reducing false-positive detections and increasing sales

- Reducing the workload of the fraud management team

CUTTING-EDGE FRAUD SCORING ENGINE:

PERFORMANCE COMPARISON:

Fraud Management System

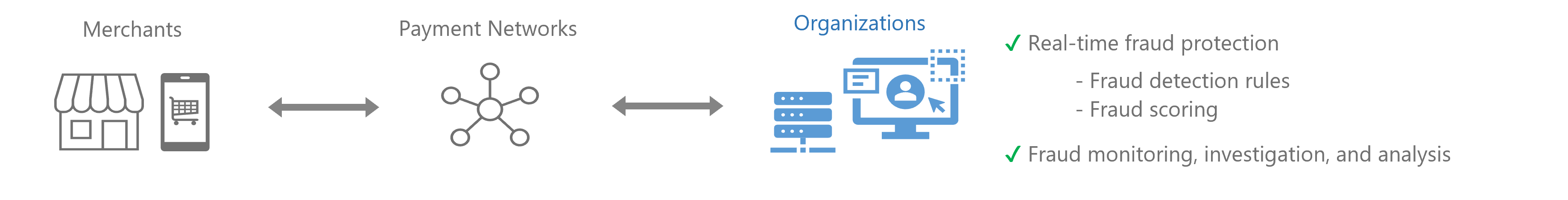

Our fraud management system stops fraudulent credit card transactions in real-time.

Using the system, organizations are able to monitor fraud, investigate cases, and analyze details with great efficiency.

- The largest market share in Japan

- Fast data processing, high availability, and high security

- Supports both rule-based and score-based fraud detection

- Available either on-premises or as a cloud service

REAL-TIME FRAUD PROTECTION:

PRODUCT VARIATIONS:

ACEPlus - On-premises Fraud Management System

IFINDS―Cloud-hosted Fraud Management System

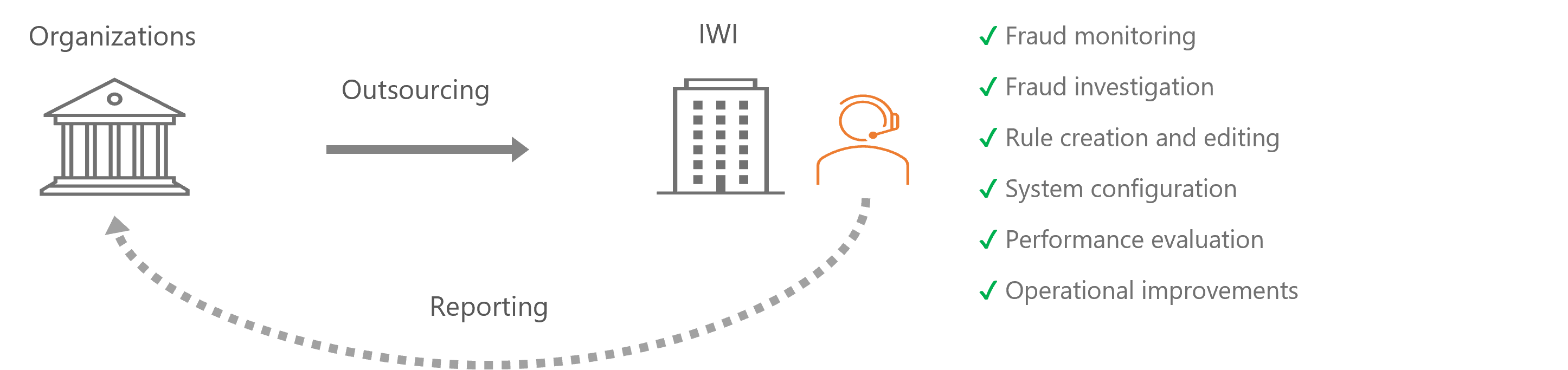

Fraud Management Operations

We perform fraud management operations such as transaction monitoring, fraud investigation, analysis, and reporting for organizations that wish to outsource their operations.

By outsourcing the operations, organizations will receive the following benefits:

- Able to concentrate on the core business activities

- Reducing the burden of organizing a professional team, recruiting, and training

- Reducing the operating cost

OUR COMPLETE SERVICE: